By Laurie B. Beasley, President, Beasley Direct Marketing

We’ve been sourcing B2B (business-to-business) prospect lists for our clients for more than 25 years. A lot of players have come and gone in that time. Dunn and Bradstreet (D&B) is the oldest list owner, and start-ups like Netprospex and Discover.org have come along. Some prospect list companies license their data for continuous updates in your CRM system, and some lists, like OmnichannelBase and Saphhire, offer lists for single or multiple campaign use. The question we are asked most often is “How do you tell which is a good list and which is a bad one?” We’ll try to answer that.

How to Tell Good B2B Prospect Data vs. Bad

Five criteria determine list quality and appropriateness for your purpose:

- Amount and completeness of data available

- The data source

- How the data is validated

- What selections are available

- Are lists single or multiple-use?

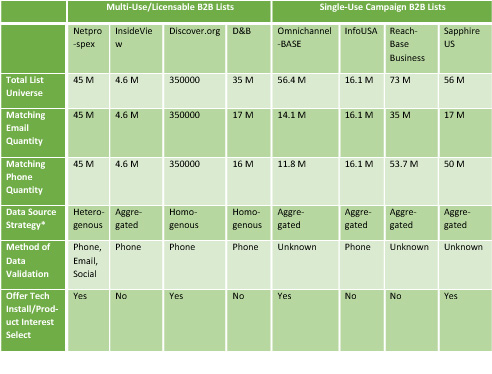

In the chart below we show several B2B list providers and some of their features.

Figure 1: B2B Prospect List Provider Features

*Data source strategy definitions:

Heterogenous: Multiple types of data sources

Aggregated: Data collected and re-sold

Homogenous: One source of data, such as phone surveys

Evaluating a Prospect List by the Amount and Completeness of Data

The first criteria to evaluate a B2B list by is the amount of data they have available for your target market. As you can see from the chart above, the total amount of data available from various list providers varies greatly. For example, you have ReachBase, which boasts a stunning 73 million records, and we have Discover.org, which offers 360,000 records (they specialize in IT, Marketing and Finance job functions). The first thing you should do in your list search is give the list vendor a list of key selections for your target market. This should include: job function, industry, company size, and geography (if appropriate). You should also ask how complete the contact records are. For instance, ask how many of the contact records have matching email addresses and phone numbers.

Ask the List Owner How They Collected the List

The second criteria you should evaluate is the data source. In other words, how was the data collected? Some list owners are homogenous in their approach. They compile their data from one source, such as making phone calls to companies. Other list vendors aggregate their contacts from multiple sources, such as publications and websites. Other list vendors are heterogeneous; they do both phone validation and aggregation. The more sources for a list, the more complete and valid it is likely to be.

Check on How Frequently the List Is Updated

The third criteria you should use to evaluate a list is how often the data is validated or updated. How do they know their contacts are good? The more (and most recent) validation points, the better. Some lists don’t validate. Others use phone only. Others, like Netprospex, use phone, email, and social media to validate contacts. In our experience, the more validation points, the better the list will be. You should also ask how frequently they validate. Some list owners do so once per year. Others validate every 30 to 90 days. The more recent, the better quality the list will be.

Make Sure the List Has Your Targets

The fifth criteria for evaluating a list is whether they have your target market available in their database. If you’re marketing financial or IT products, you want to make sure they have contacts that are decision makers for those products. List owners profile product “interest” two ways: The first way is by profiling a target account by the technology they use. Some lists can tell you what financial or IT products are installed at a corporation. The other way is to profile by their product interest or purchase authority. This is typically done when a target fills out a qualification form to receive a free industry publication, or publishers will compile data on which white papers or webinars a target requests.

Find out Whether the List Owner Is Making Contacts Available for Single or Multi-Use

Lastly, find out if the contacts you purchase are for single or multi-use. This will affect your pricing, and your ability to email that contact only once or multiple times. Some list owners will only make the contact postal/phone numbers available to you, and for CAN SPAM compliance purposes, will send an email out on your behalf. This is most helpful in countries with email spam laws, such as the U.S., Canada and Germany. Some list vendors offer a service to continually update and clean records in your CRM. This is especially helpful, since Discover.org reports the following statistics about company data*:

- 40% of email users change their email address at least once every two years

- 20% of postal addresses change every year

- 18% of phone numbers change every year

- 60% of people change job functions within their organization every year

With that kind of movement, we highly recommend you clean your in-house data at least quarterly or best case continuously, using a list owner that offers that data cleansing service.

Seek Lists That Offer the Most Completeness and Validation…and Then Test Them!

Our experience in sourcing lists has told us that seeking the most complete, most updated, and most segmented lists will perform the best. Your best bet is to compare list options and pricing. Don’t be afraid to ask hard questions of the list owner. Some list vendors are proud of how they maintain their records and some try to hide that information. Then test. Order 10,000 records from your two or three finalists and do a test campaign. The ultimate proof of the quality of a prospect list will be in how many leads or orders you get through using it.

If you want help comparing or ordering B2B lists, feel free to contact Beasley Direct Marketing, Inc. at www.BeasleyDirect.com

*Discover.org, “The High Cost of Bad Data,” 2014.

* * * *

This blog was authored by Laurie B. Beasley, co-founder and president of Beasley Direct Marketing, Inc. Beasley Direct is a Silicon Valley direct marketing agency that has managed search, email, online, and demand generation campaigns for nearly 100 companies. Ms. Beasley serves as President of the Direct Marketing Association of Northern California www.DMAnc.org. She manages the eMarketing Roundtable for the BMA Northern Californiawww.NorCalBMA.org. She is also an instructor of online marketing at UC Berkeley Extension and teaches for the Online Marketing Institute www.onlinemarketinginstitute.org. Ms. Beasley frequently speaks on online marketing and demand generation topics for marketing organizations, including the DMA, BMA, AMA, Tech Council, and the Online Marketing Summit.